In early January, Executive Councils hosted a C-suite briefing focused on the economic conditions shaping 2026. Moderated by Neil Brown, CEO of Executive Councils, the session featured Curtis Dubay, Chief Economist at the U.S. Chamber of Commerce. The discussion centered on growth expectations, policy risk, labor dynamics, inflation, and the expanding role of artificial intelligence, all through the lens of decision-making for senior executives.

session featured Curtis Dubay, Chief Economist at the U.S. Chamber of Commerce. The discussion centered on growth expectations, policy risk, labor dynamics, inflation, and the expanding role of artificial intelligence, all through the lens of decision-making for senior executives.

Dubay opened by acknowledging the tension many leaders feel when reviewing economic signals. On paper, growth remains solid. In practice, confidence among consumers and businesses continues to lag. As he noted, “The data we have shows the economy is in pretty good shape. That does not jive though with how people feel about the economy.” This disconnect set the tone for a wide-ranging conversation about what the numbers say and why sentiment has not followed.

Growth Outlook: A Narrow Band with Wide Implications

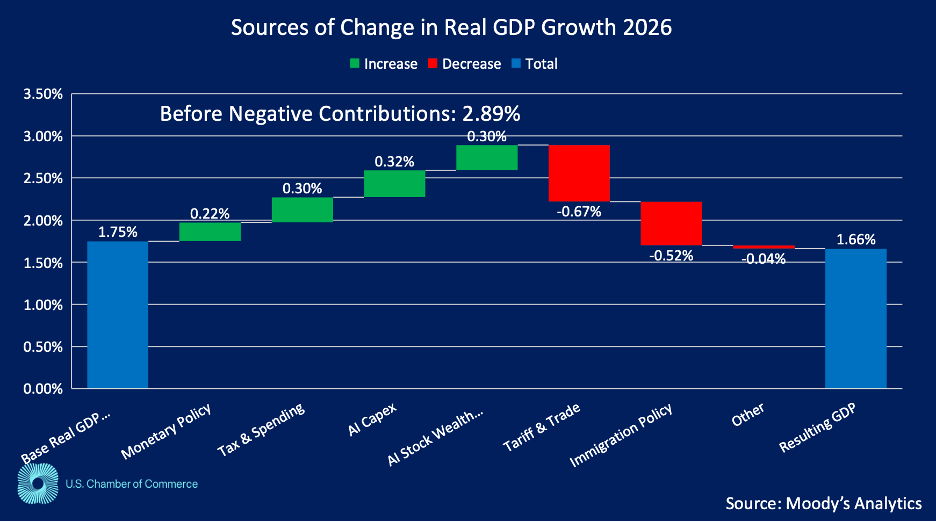

According to Dubay, the most likely outcome for 2026 is growth near the economy’s long-term potential. “If nothing else changes, the economy will grow about 2% this year,” he said. That baseline, however, masks meaningful upside and downside risk. Under the right conditions, growth could approach 3%. Under the wrong mix of policies, it could slip closer to 1%.

Two forces are carrying the economy forward. Consumer spending continues to surprise on the upside, supported by job availability and wage growth that remains above inflation. At the same time, business investment, particularly in artificial intelligence and the infrastructure that supports it, has become a central driver of expansion.

Dubay emphasized that consumer strength has persisted longer than many expected. “We’ve all been waiting kind of for the other shoe to drop when it comes to consumer spending… and yet, quarter after quarter, year after year, they continue to spend at a really impressive pace.” While higher-income households account for a visible share of discretionary spending, middle- and lower-income households are also maintaining consumption by using wage gains to offset higher costs for essentials.

AI Investment and Productivity Gains

On the business side, Dubay pointed to AI as both an immediate and long-term contributor to growth. Investment in data centers and related equipment is creating jobs across construction, electrical work, HVAC, and water systems. Beyond capital spending, AI is amplifying productivity, which Dubay described as one of the most important indicators of economic health.

“Productivity growth in the US is really, really strong,” he said, adding that this trend predates the most recent wave of AI adoption. The implication for executives is twofold. First, AI-related investment is likely to continue in 2026. Second, productivity gains are helping explain why companies have been able to support higher wages without undermining profitability.

Dubay also framed productivity as a competitive advantage for the United States. Other developed economies, particularly in Europe, have struggled to generate similar gains. In his view, regulatory posture plays a role. The US response to AI has focused on enabling adoption, while other regions have leaned more heavily toward precautionary regulation.

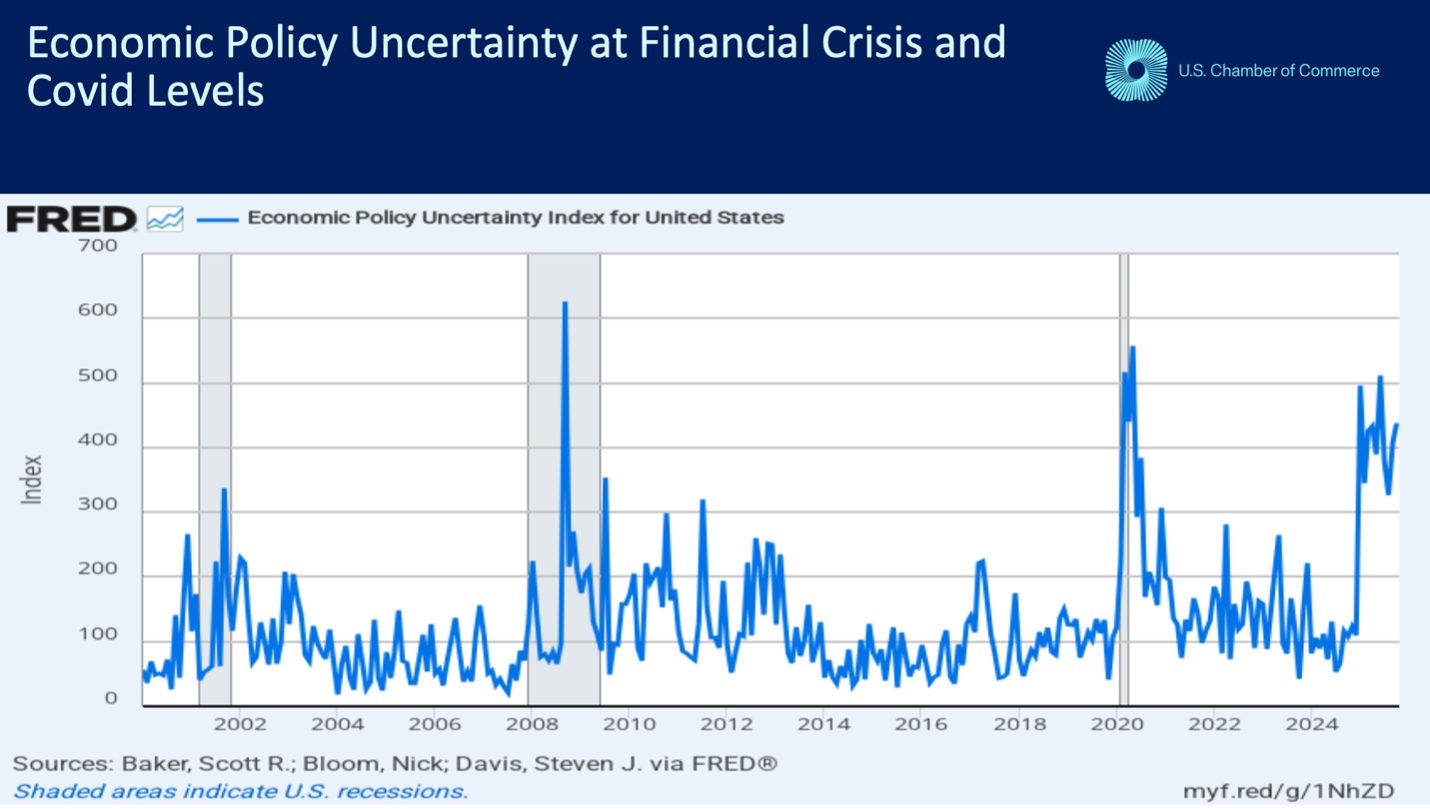

Policy Uncertainty as a Restraining Force

Despite positive fundamentals, Dubay returned repeatedly to policy uncertainty as a limiting factor. He cited measures showing uncertainty at levels exceeding those seen during the global financial crisis and the pandemic. “Businesses don’t like to invest in situations where they don’t know what policy is going to be going forward,” he said.

Tariffs remain a central source of that uncertainty. While their immediate impact on growth has been muted, Dubay explained that costs are increasingly being passed through to consumers as inventories normalize. “When tariffs go up, raise the prices of imported goods, all prices go up,” he said, describing how domestic producers gain pricing power when foreign competitors face higher costs.

The direction of tariff policy in 2026 will matter. Lower average tariff rates could provide a meaningful lift to growth. Additional tariffs, or continued volatility in their application, would likely weigh on investment and confidence.

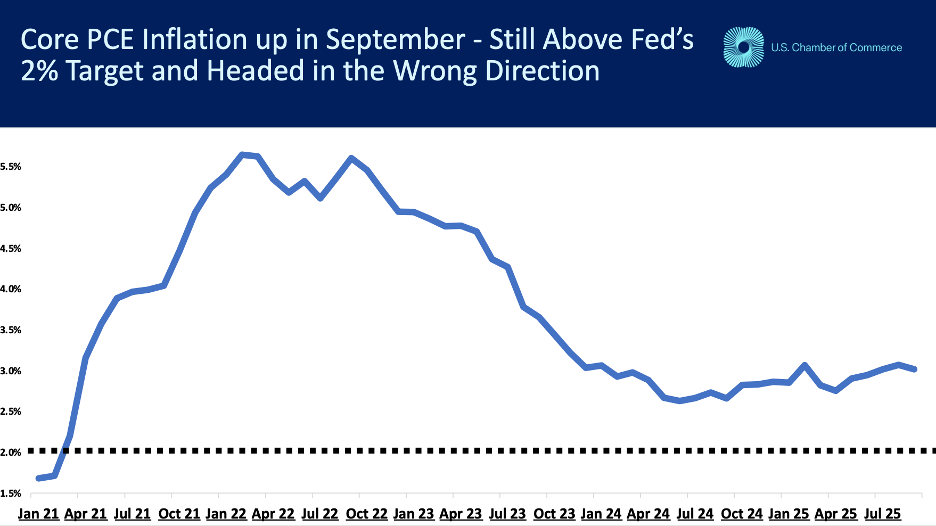

Inflation, Rates, and the Federal Reserve

Inflation remains another area where perception and data diverge. Headline inflation has moderated to roughly 2.7% annually, still above the Federal Reserve’s 2% target. Dubay explained that tariffs complicate the Fed’s task, since they raise prices for specific categories rather than across the board.

“The problem for the Fed is that they don’t control tariff policy,” he said. As a result, interest rate decisions must account for price pressures that monetary policy cannot directly influence. Dubay expects rates to remain relatively stable through 2026, with limited room for additional cuts.

He also addressed affordability, particularly in housing and everyday expenses. While inflation may slow, price levels are unlikely to revert. “That’s not how inflation ends,” he said, noting that relief comes from sustained wage growth outpacing prices over time rather than from outright price declines.

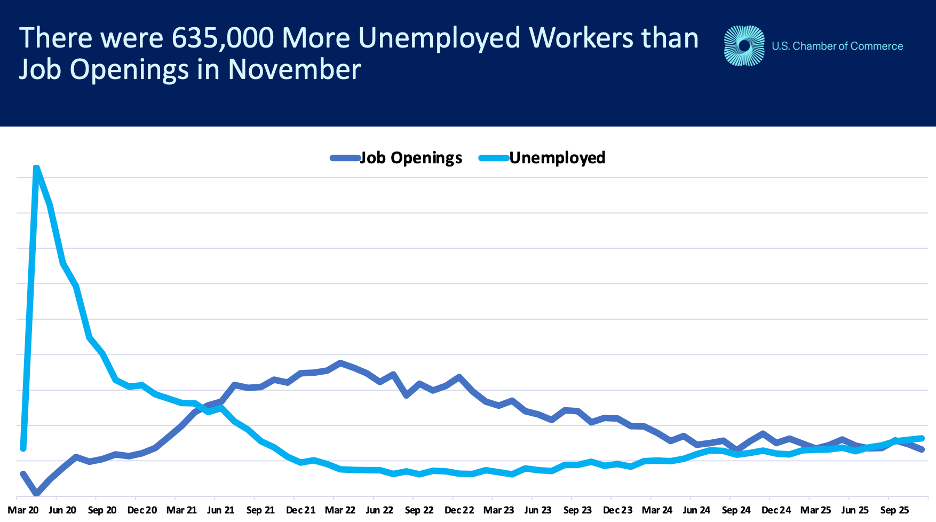

Labor Market Constraints and Demographic Shifts

The labor market discussion resonated strongly with the executive audience. Hiring has slowed, but Dubay cautioned against interpreting this as weakness. Due to demographic trends, fewer new jobs are required each month to maintain stable unemployment.

Recession Risk and Executive Planning

Looking ahead, Dubay does not expect a recession in 2026 absent a major external shock. He distinguished between a slowdown and a contraction, noting that slower growth may feel uncomfortable without meeting the technical definition of a recession.

For business leaders, his guidance was pragmatic. “Prepare for things to be kind of the way they’ve been the last year or so going into 2026,” he said, while also remaining ready for both upside surprises and unforeseen disruptions.

Watch the Full Webinar

The 2026 Economic Outlook C-Suite Briefing offered a clear-eyed assessment of where the economy stands and what senior leaders should watch in the year ahead. To hear Curtis Dubay’s full analysis, including audience questions on debt, geopolitics, and M&A activity, watch the complete webinar here.

0 Comments