In today’s business landscape, the marriage of technological innovation and financial prudence has become imperative for sustainable growth. This is because cloud-based solutions provide unparalleled flexibility and scalability.

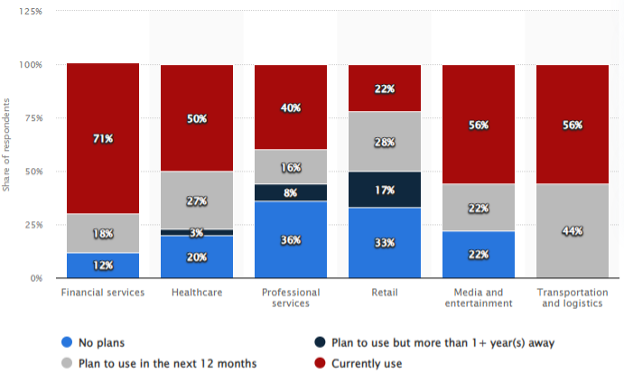

In 2023, a majority of companies had already adopted cloud operations. The financial sector was the largest adopter, with 71% of organizations currently using cloud computing to an extent. Their most prominent use? FinOps.

Source: Statista

With cloud services, a delicate equilibrium between superior performance, uncompromising quality, and judicious cost management comes into play. Amid this intricate web of considerations, a transformative approach emerges: Financial Operations or FinOps.

This groundbreaking methodology transcends traditional boundaries, seamlessly integrating financial acumen and operational finesse. The overarching goal? To empower organizations with the tools and strategies required to navigate the realm of cloud financial management.

The Popularity of FinOps

According to a comprehensive study by Gartner, worldwide public cloud end-user spending is projected to reach a staggering $597.8 billion by the end of 2023. This is a testament to the profound shift towards cloud-centric strategies. In this landscape, cloud financial management becomes pivotal, shaping the trajectory of organizations’ growth and success.

However, at the same time, 76% of organizations consider optimizing cloud costs as a top priority. This shows that there is an urgency to harmonize operational efficiency. This conundrum has given rise to The FinOps Revolution. It has allowed CIOs, CTOs, and COOs to transcend conventional paradigms.

Unveiling the Power of FinOps

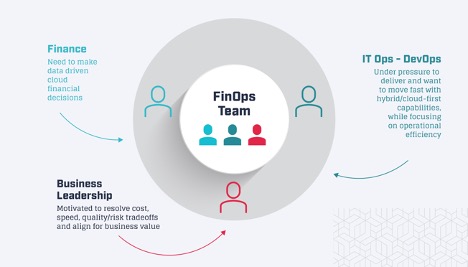

At its essence, FinOps offers a strategic framework that brings together diverse organizational entities under a unified banner. Just as orchestras blend individual musical instruments to create harmonious symphonies, FinOps orchestrates cross-functional collaboration between several teams. Normally, this includes:

- IT,

- Finance,

- Product, and

- Management teams.

Combining these teams continuously improves visibility, price optimization, quantity management, and ultimately, cost architecture.

This holistic understanding of cloud costs and performance empowers your organization to make informed decisions.

Harnessing Financial Control

FinOps infuses your organizational DNA with a newfound sense of financial ownership. It enables each product team to manage their cloud usage within allocated budgets. This, in turn, empowers them to take charge of their cloud journey.

This ownership-driven approach of FinOps ensures that every team is equipped with the tools, insights, and practices needed to comprehend cloud costs, set performance benchmarks, and track progress over time. The result? A robust culture of accountability that scrutinizes cloud costs and prompts in-depth examinations whenever goals are missed.

Pioneering Centralized Savings

While collaboration remains pivotal in the FinOps realm, a core team emerges as the torchbearer of cost-saving initiatives.

This dedicated team takes the reins in identifying and governing cloud cost benefits, ranging from committed use discounts to reserved instances and volume-based concessions. The team’s centralized efforts ultimately translate toward the organization’s benefits. Some key benefits include:

- Streamlined negotiations,

- Effective allocation of costs, and

- Unburdened engineering, testing, and operations.

Better Reporting, Better Decisions

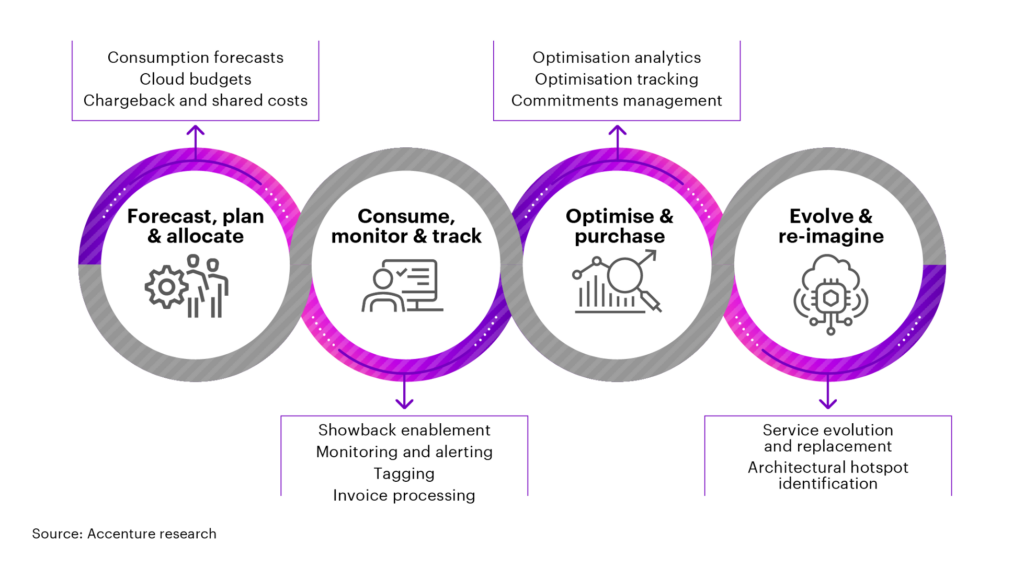

In the FinOps ecosystem, accurate and timely reporting becomes the lighthouse guiding your financial voyage. Reporting not only tracks cloud expenditures but also delivers performance metrics that serve as a compass. This guides the FinOps team in evaluating the efficiency and impact of cloud deployments.

The insights gained therein empower upper-level executives to:

- Make better decisions,

- Optimize cloud budgets,

- Detect over- or under-provisioned workloads, and

- Fine-tune strategies for achieving the delicate balance between cost and value.

This translates into a better workforce and lower employee turnover.

A Value-Centric Approach

At the heart of every organizational endeavor lies the pursuit of value. FinOps propels this pursuit to new heights, aligning cloud decisions with tangible business value.

By benchmarking cloud workloads and costs, FinOps teams gain the insights needed to gauge business performance against cloud investments. This value-driven approach ensures that every cloud-related decision is underpinned by a thorough examination of its contribution to your organization’s strategic objectives.

Better Variable Cost Navigation

In the dynamic sphere of cloud services, overprovisioning and underutilization pose significant financial pitfalls. FinOps introduces a vital dimension – the variable cost models inherent to cloud offerings. This nuanced understanding enables your organization to exploit opportunities for cost optimization.

By appropriately sizing cloud instances, retiring unused resources, and effectively scaling resources, you seamlessly align costs with performance, ensuring financial prudence without compromising operational excellence.

Navigating the Organizational Imperative

The crux of the challenge lies in orchestrating a symphony of cloud performance, quality assurance, and judicious cost containment. There are four primary challenges that operational executives face when it comes to FinOps:

- Getting engineers to act

- Shared costs

- Forecasting and false positives

- FinOps, on its own, can lead to wastage if not implemented effectively.

Cloud services, intricately designed by technical architects and engineers, are brought to life by IT operations teams. On the other hand, the financial implications reverberate throughout every department. The result? A complex puzzle where each piece operates in isolation. This can lead to inaction, high costs, inefficiency, frustration, and suboptimal outcomes.

This is where FinOps emerges as a beacon of transformation. Just as DevOps dismantles silos between development and operations teams, FinOps harmonizes IT, finance, product, and management entities.

The objective is clear – to forge a collaborative ecosystem where cost-conscious decision-making and operational excellence coalesce seamlessly.

Charting the Course: Heading Towards A FinOps-Enabled World

In a world driven by data-driven decisions, the role of Managed Service Providers (MSPs) becomes pivotal. MSPs, equipped with FinOps expertise, emerge as the custodians of cloud financial management. By offering FinOps services, MSPs are bridging the gap between financial acumen and operational efficiency.

In this journey towards organizational excellence, the importance of selecting the right partner solution cannot be overstated. As the landscape evolves, the tools that facilitate multi-cloud visibility, automated monitoring, and robust cost allocation become the cornerstones of FinOps’ success.

In the heart of the dynamic interplay between cloud services, financial stewardship, and operational finesse lies the promise of FinOps. It is a transformative force that empowers organizations to achieve unparalleled excellence, optimize costs, and pave the way for a future defined by strategic alignment, financial prowess, and sustained growth.

0 Comments