Operations Council recently held a webinar on the 2024 COO/Operations Sentiment Study Results – Webcast Panel.

Our expert panelist was Courtney Rottman. Courtney is COO for Care Technology at EverNorth Health Services, a Cigna Corporation. She has more than 20 years of experience serving in operations leadership roles, including St. Jude’s Children’s Research Hospital – ALSAC, Baylor Scott & White Health, Susan G. Komen for the Cure, and Travelocity.

Courtney earned a Doctor of Business Administration, a DBA at the International School of Management in France just recently, in fact, and has a Master of Public Service and Administration (MPSA), along with a JD in law and a BA International Studies and History from Texas A &M. Courtney is a certified Chief of Staff and served on the Forbes Nonprofit Council. She currently serves as vice president on the board of directors at Nexus Recovery Center.

During this discussion, Courtney discussed several key predictions for changes in financial metrics, spending, talent and more in 2024. If you are interested in learning more, view the full webinar archive video here.

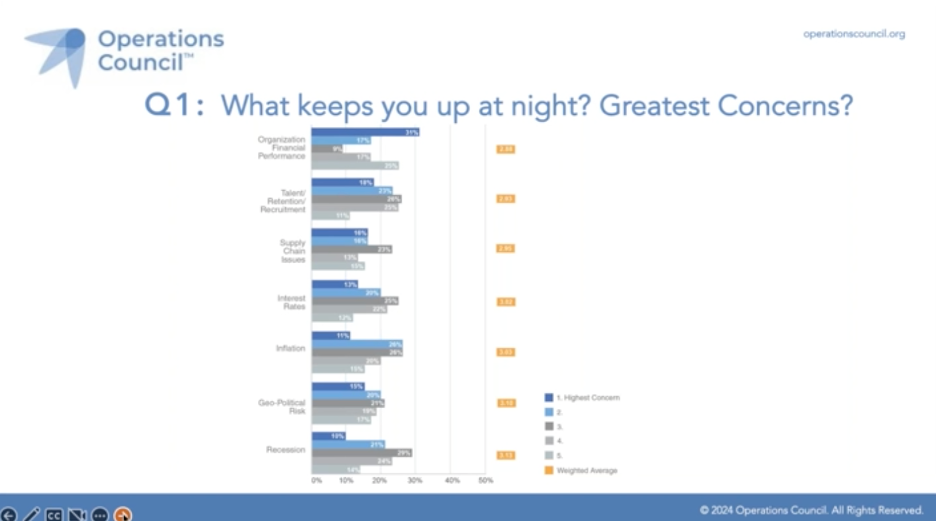

Takeaway 1: Greatest Concerns includes Financial Performance, Talent, Supply Chain, Interest Rates, Inflation, and Geopolitical

The number one rating in dark blue is the highest concern listed lowest weighted average to highest. So, all concerns are ranked or clustered near the middle of the one to five scale. Organizational financial performance ranked highest with 31 % concern and along with the lowest weighted average. Talent a close second and supply chain close third in weighted average. Interest rates inflation and geopolitical risk and recession follow.

Courtney: It’s interesting to see where things kind of stack out. I’m not an anomaly, that’s for sure. I personally always am most worried about talent retention recruitment. And I think that’s been increasingly so for me in the past few years, especially with the fears that we’ve heard from talent at various organizations associated with the role of AI in digital transformation. Those are passion areas of my personal study. And I think it’s really fascinating because at its core with all of the work that we do, people are the enablers of that.

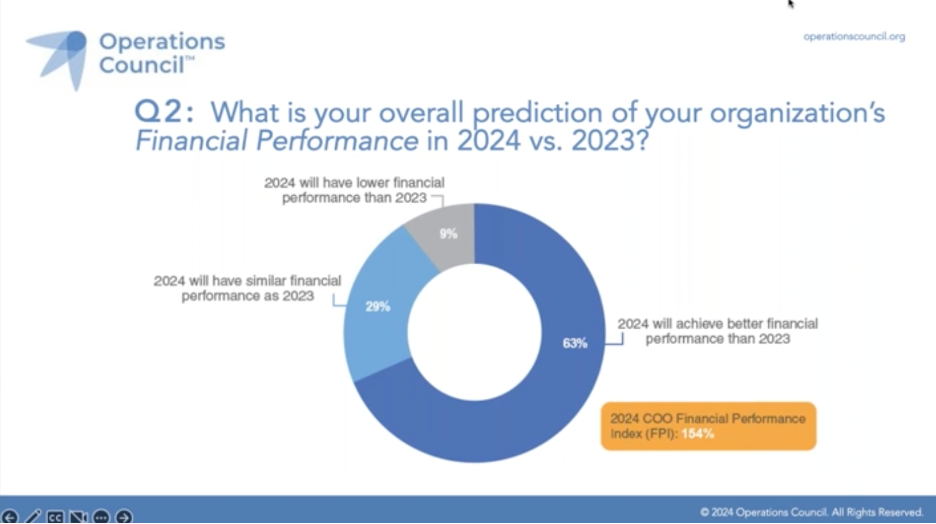

Takeaway 2: 2024 COO Financial Performance witnessed a “bullish” 154% Index with 63% increasing and only 9% decreasing

Courtney: I think what’s interesting about this and all the respondents reflect that while we’re anticipating growth, some of those concerns that we all have are cost drivers as well. So, we’re really talking about some exponential revenue growth and that’s exciting to see across our various sectors, you know, represented on the call today and in the study. So, while I’m anticipating, revenue growth at my own organization, you know, just managing costs and keeping those in line with where we see ourselves not only this year, but in our years to come.

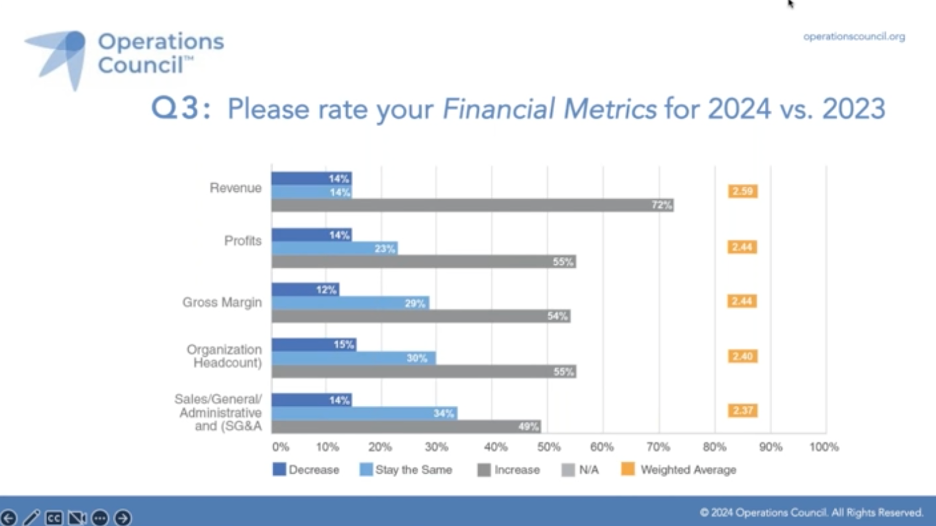

Takeaway 3: Financial Metrics – increases predicted for Revenue by 72%, Profits by 55%, GM by 54%; with cost increases for Head Count by 55%, and SG&A by 49%

Revenue leads all financial metrics with 72%, followed by profits, which has a 55 % increase and gross margin 54%. So, then we get into some of the cost metrics and organizational headcount is right there with 55 % increases and SG &A with 49 % increases. So are these increases aggressive considering the business and economic environment?

Courtney: I don’t think that they are aggressive. I personally work in healthcare. And what I will suggest is that, you know, we are still understanding and living through the ramifications of COVID and the impact that it had on our financials. I think that, you know, officially the COVID pandemic ended last year. We have three years of impact that are just starting to come into, you know, normalcy now in 2024. I think it’s really fascinating to explore the gross margin piece in particular, because with the org headcount as a cost increase that we saw happen during COVID, especially in the healthcare and other sectors as well, trying to normalize that as revenues draw back into line and people start, you know, receiving goods and services at the frequency and pace that they did before, you know, there is going to be an impact that I think we’re going to have to continue to adjust to.

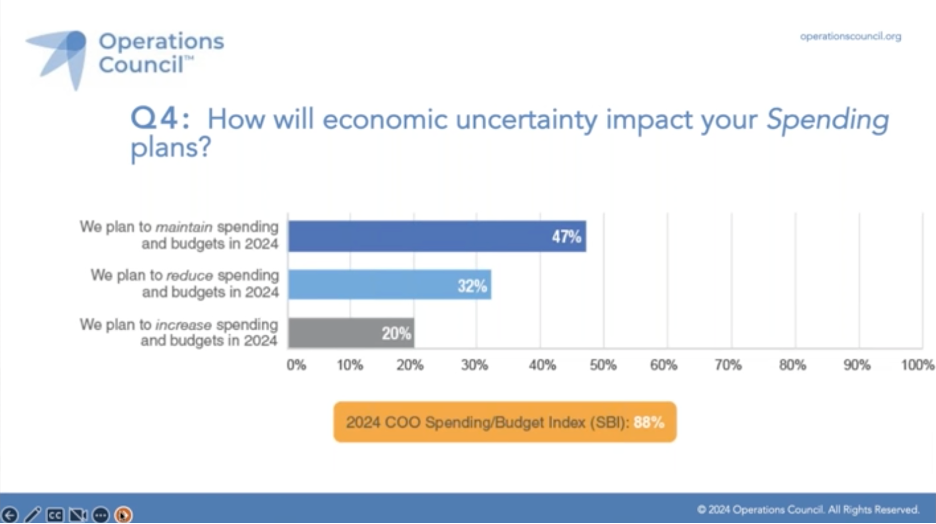

Takeaway 4: Spending Outlook – reduced budgets are anticipated by 32%, with only 20% increasing for a cautious Spending/Budget Index of 88%

How will economic and uncertainty impact your spending plans? And a majority here, 47%, will maintain spending.

Courtney: I think the monthly and the quarterly forecasts are becoming more and more important because of the variability that we’ve all experienced in the last few years and understanding what our new normal trend lines are. So, I would put myself personally in that more cautious camp. And as I alluded, not really having the historical for the last three years in a normal environment is part of the drivers for that. I don’t think it’s organization specific based on how the respondents have participated in the study, but I do think it’s very good news that we’re less cautious than we were in 2023.

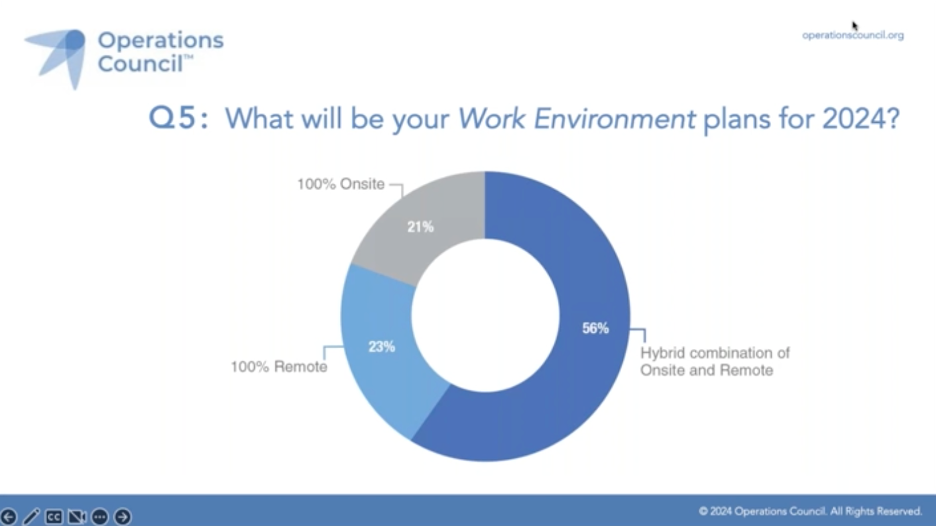

Takeaway 5: A majority 56% of organizations are planning a hybrid combination of onsite and remote work environment, followed by nearly equal 23% completely remote, and only 20% completely onsite

What will be your work environment plans for 2024? Hybrid 58%, a big majority there. And then on-site and remote tide, which is very interesting.

Courtney: Well, at EverNorth, we’re hybrid. We do try to set some expectations for people coming together to collaborate in person. There’s a lot of interest in that. But our own workplace climate surveys and the feedback of our employees is what drives that strategy. So, I’m proud of our leadership team for driving not by what we did in the past, but what our team members want in the future. And they want more time to collaborate in person together. However, we’re not mandating schedules. We’re not dictating where that work happens. So, there’s some cost drivers around being able to travel and bring multinational, you know, when you have a multinational team as we do, bringing people together is expensive. But we’re leveraging technology where we can. Forums like WebEx and Zoom are all great ways, but there’s a lot of fatigue in that. So, we’re seeing that there’s a desire to come back together, but we want to balance that. We especially want to be cognizant of people that have disabilities, working mothers.

To view the complete webcast panel discussion, click here.

To download/read/print the 2024 COO/Operations Sentiment Study Results Report, click here.

0 Comments