With advances in technology and sustainability strategies, smaller companies can improve their procurement practices. While leading procurement companies are using innovative approaches to stay ahead and prepare for the next decade.

This month, McKinsey released a procurement benchmarking survey which reveals the tools, capabilities, and ways of working that are helping leading companies protect their profits during turbulent times.

As reported by McKinsey on July 12th, 2024 by Riccardo Brentin and Samir Khushalani with Christopher Kloos and Prachi Misra.

Where procurement is going next

Anyone who has tried to buy a new car in the past 24 months understands the importance of an effective procurement capability. The coronavirus pandemic disrupted industries around the world, but the global automotive sector suffered perhaps the biggest hangover. As demand plummeted in 2020, automakers slashed production and cut orders for parts. When consumers returned months later, purchasing teams found that manufacturers of critical semiconductor components had already shifted production capacity elsewhere.

At the height of the crisis, lead times for some automotive chips were four times their long-term average. Procurement teams who understood dynamics of the volatile semiconductor market adapted quickly to maintain supplies, but other companies simply couldn’t get the critical parts they needed. In 2021 and 2022, semiconductor shortages prevented the production of an estimated 13 million vehicles worldwide. While lead times have now largely dropped back to normal, vehicle production and sales volumes are not expected to return to precrisis levels until the end of the decade.

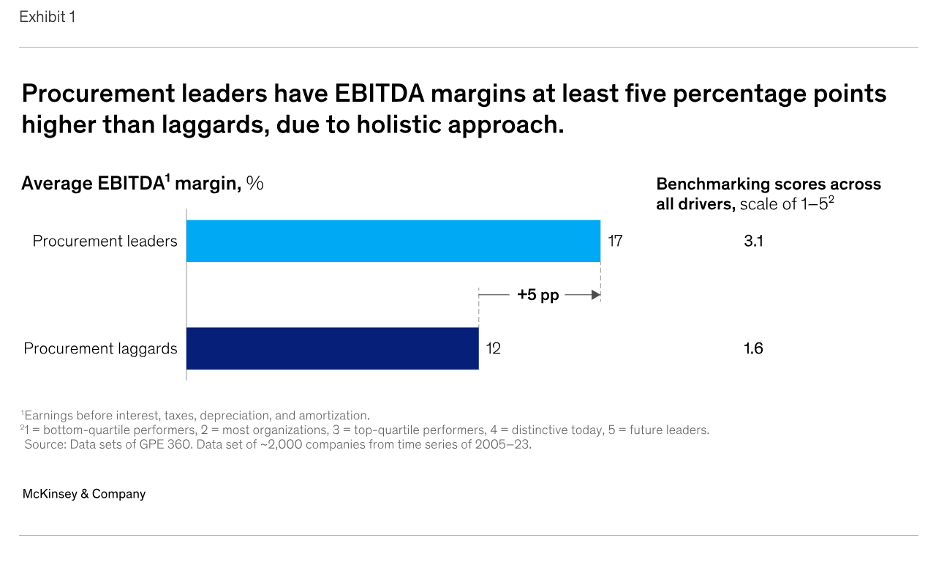

When we launched our first procurement benchmarking survey nearly two decades ago, we uncovered a clear link between greater procurement maturity and higher business profitability. That link still holds today. Despite all the recent turbulence, our latest benchmark analysis shows that companies with top-quartile procurement maturity have EBITDA1 margins at least five percentage points higher than their less mature peers (Exhibit 1).

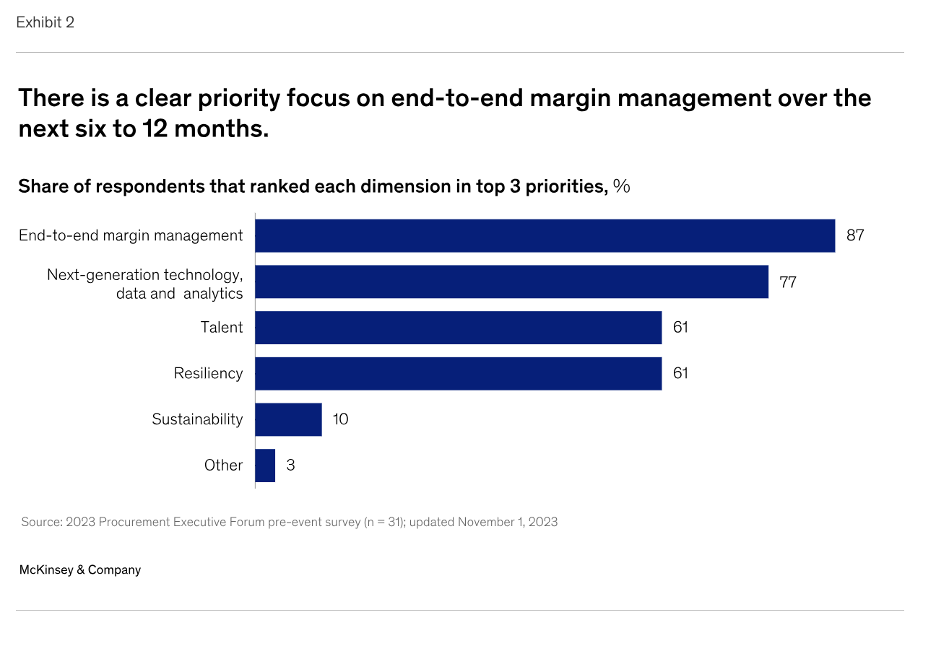

Today’s procurement teams face multiple, simultaneous demands (Exhibit 2). They must mitigate the impact of inflation while managing the supply and supplier risks that can damage reputation or threaten business continuity. That’s driving a change in approach, with companies abandoning old approaches to globalization and supplier consolidation in favor of a new model that prioritizes supplier diversification and risk management. In many categories, they must also manage increased price volatility by taking a fast-moving and dynamic approach to hedging against future cost increases or taking advantage of savings opportunities in favorable markets. Procurement teams are also at the forefront of the sustainability transition, charged by their organizations with identifying, qualifying, and developing future sources of resource-efficient, low-carbon inputs.

While they are dealing with those pressures, CPOs are also striving to reinvent their own organizations. Most face significant talent shortages, in both traditional procurement skills and the technical and analytical capabilities needed to deploy and run advanced digital technologies. The talent shortage is emphasizing the need for digital solutions as a potential answer. Companies have launched digital transformations but are concerned that they are not proceeding fast enough.

CPOs step up

From our conversations with senior procurement executives, we know that most are embracing these challenges. They’ve been arguing for years that procurement should have a strategic role within the company. Now they have it.

At the same time, the new procurement environment can expose weaknesses in an organization’s processes, tools, and digital infrastructure. Some executives worry that they don’t have the information they need to make effective decisions: they have a limited view of the organization’s total spend, too much data that is inaccurate or of poor quality, and difficulty integrating data from multiple sources to create a comprehensive and accurate category view.

A multidimensional challenge

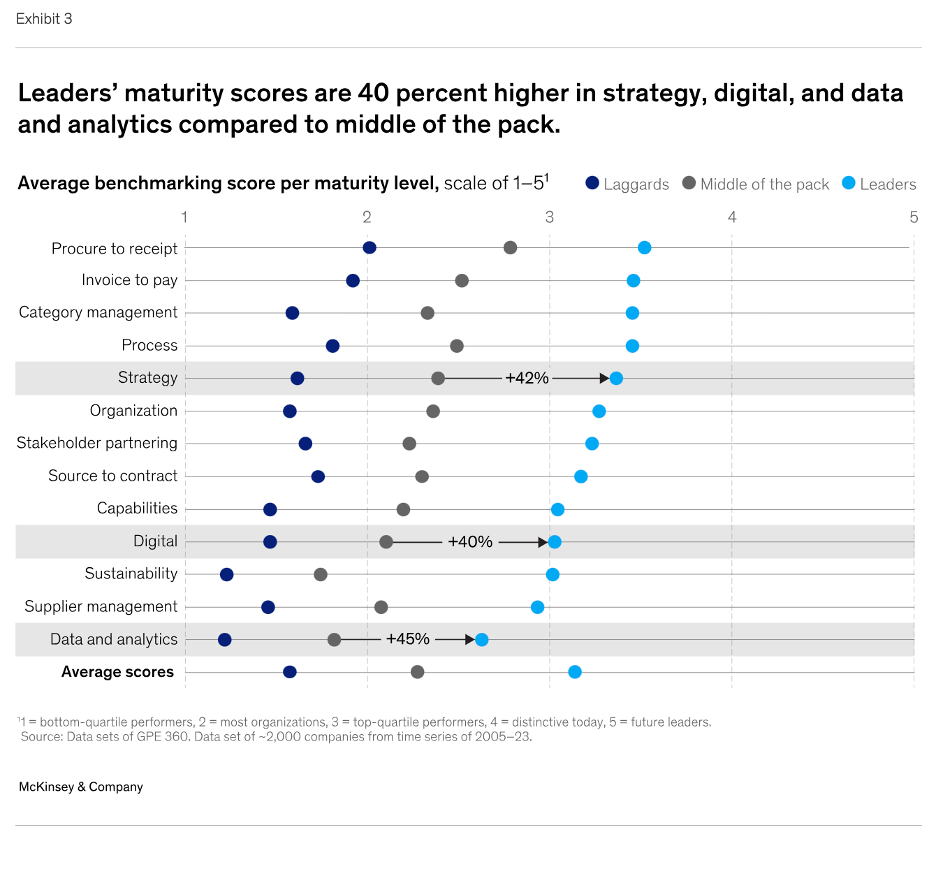

A key long-term finding from our benchmarking is that there is no shortcut to procurement excellence. High-performing procurement functions don’t excel in just one or two maturity dimensions, they excel in many of them. Comparing the top- and bottom-quartile organizations in our data set shows that this is still the case. Leaders achieve twice the maturity of laggards across six broad dimensions: procurement strategy, category management, digital, data and analytics, organization, and skills.

One international petrochemical player worked on all these dimensions as part of a major project to transform its procurement performance. The company invested in new digital tools and analytics approaches, and trained more than 100 people to use them. It ran an in-depth analysis of its spend across more than 50 high-value categories, identifying total savings opportunities of around $100 million per year. It then engaged the entire procurement organization in several category-specific initiatives to capture these savings and implemented a new dashboard system to track supplier performance.

A year later, the company had exceeded its savings targets, reducing spend in the targeted categories by $120 million per year, with an average savings of 12 percent. This effort was enough to move it from the second quartile to the top quartile in our benchmark.

Digital makes the difference

When we compare the very best procurement organizations to their midtier peers, we find the most significant differences in a more focused set of dimensions. Top performers have maturity scores at least 40 percent higher than average players in strategy, digital, and data and analytics (Exhibit 3). The best procurement organizations understand that success in today’s complex and fast-moving environment requires mastery of data-driven decision-making. They have invested in the digital infrastructure and analytical tools and capabilities needed to achieve this goal.

A global retail chain used a data-driven procurement approach to achieve a tenfold improvement in savings across portions of its $4 billion annual indirect spend. In a program that targeted six of its largest indirect categories, the company applied a suite of digital and analytics tools, including AI-assisted category analysis and geospatial analysis to create clusters for maintenance insourcing projects. A new procurement academy trained procurement staff in these and other tools, equipping them to look for new cost savings and demand reduction opportunities across categories. The company began the transformation with the goal of improving its historical annual savings rate of 1 percent to 2 or 3 percent. By the end of the process the company had reduced indirect spend by 11 percent and achieved total cost of ownership savings of more than $500 million.

Sustainability: Don’t get left in the dust

ESG is another area where our benchmarks show significant differences between top performers and the rest. Leading procurement organizations achieve sustainability maturity scores that are close to their average scores for other dimensions. These companies have integrated sustainability goals into their overall performance strategy and are developing the tools and capabilities they need to assess and continually improve sustainability performance. They are progressively improving their sustainability performance, for example, by applying smart affordable decarbonization levers and dual sourcing to reduce supplier-related risks.

Among lower-performing companies, sustainability maturity tends to lag far behind most dimensions, suggesting that these companies have yet to grasp the challenge of sustainable sourcing. This could be risky. Given the expected shortage of low-carbon and low-impact materials, companies that move quickly to develop sources and supplier relationships may enjoy preferential access to these products in the coming years.

Size needn’t matter so much

Some sectors, such as automotive and consumer products, have a high percentage of leaders thanks to a long-term focus on sourcing as a source of competitive advantage. Over the years, however, we have found high-performing procurement organizations in almost every industry.

Across sectors, the highest-performing companies in our benchmarks tend to be large organizations, where the volume of purchases makes it easier to justify investments in advanced digital infrastructure and specialized capabilities.

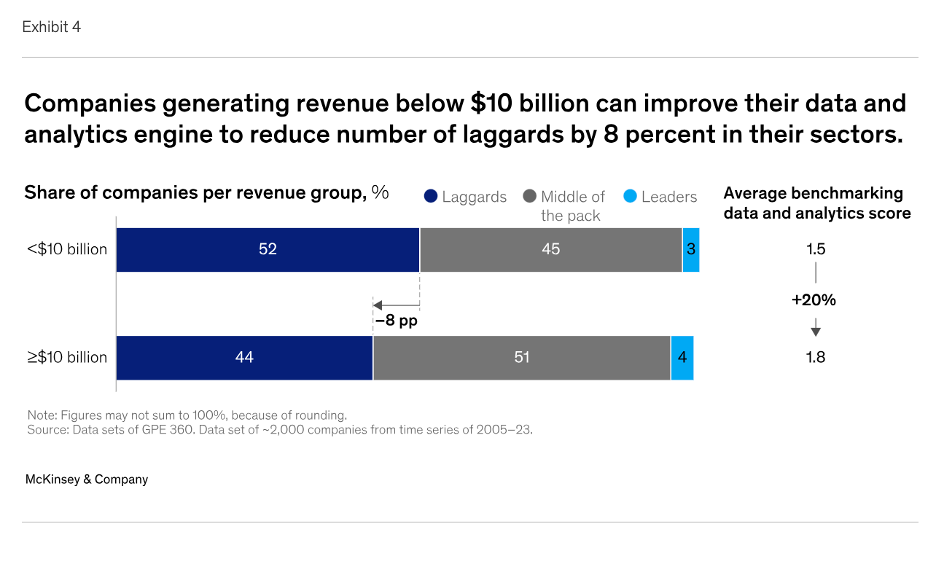

Today, however, changes in the technology landscape are eroding the advantages traditionally enjoyed by larger organizations. Sophisticated analytics tools and data platforms are increasingly accessible through lightweight, cloud-based, or modular deployments. This makes it faster, cheaper, and easier for organizations of all sizes to access the digital capabilities they need.

For the small businesses in our data set, this shift could be transformative. Improving their data analytics engine would reduce the number of procurement laggards in this group by 8 percent (Exhibit 4).

From enhanced digital capabilities to integrated sustainability strategies, leading procurement organizations are using innovative approaches to stay ahead. While larger companies have historically led the way, advances in technology are leveling the playing field and creating opportunities for smaller players to improve their procurement practices. As we move forward, it’s clear that the ability to adapt, innovate, and harness the power of data-driven decision-making will be key to procurement excellence in the next decade and beyond.

Additional Procurement Resources

The Future of Supply Chain Management: Trends and Best Practices

0 Comments